Get the free paychex new hire form

Show details

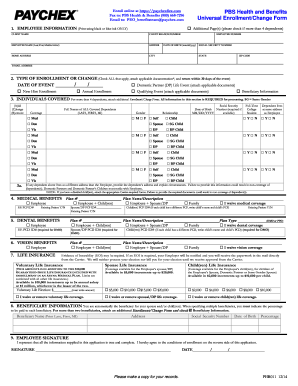

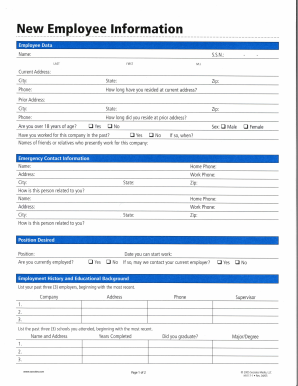

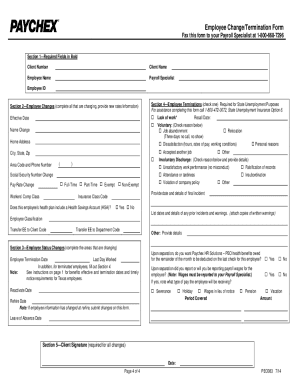

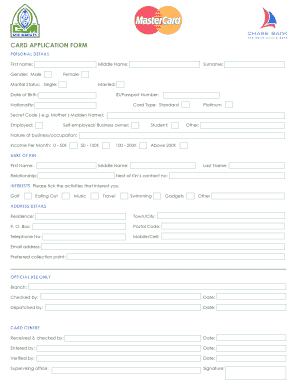

New Employee Information Employer Complete New Hire RehirePrevious Name (if applicable)EMPLOYMENT DATA Job Title Rate of Mandate of Hire//Date//Grade Hourly Salaried Full time Part time Seasonal Scheduled

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign paychex new employee form

Edit your paychex forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paychex new employee packet 2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing paychex employee information form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit paychex forms pdf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out paychex employee new hire change form

01

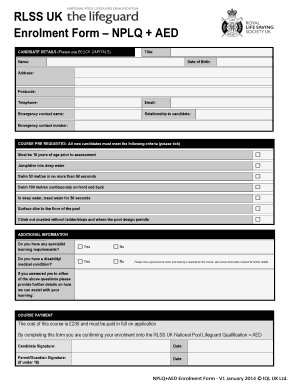

Start by collecting basic personal information of the new employee, such as their full name, date of birth, and contact details.

02

Proceed to gather their employment details, such as their job title, department, and start date. Additionally, ask for their work schedule and any necessary training or certifications.

03

Obtain their emergency contact information, including the names and phone numbers of individuals who should be contacted in case of an emergency.

04

Request the new employee's tax information, including their social security number or tax identification number, as well as their current tax withholdings or exemptions.

05

Ask for their banking details, including their bank account number and routing number, if direct deposit is utilized for salary payments.

06

Inquire about their eligibility to work in the country, requesting necessary documentation such as a work visa or permit if applicable.

07

If the new employee will be driving for work purposes, ask for their driver's license information and proof of insurance coverage.

08

It is crucial to obtain any relevant medical information, such as allergies or pre-existing conditions, to ensure a safe work environment. This information should be kept confidential and shared with necessary personnel if required.

09

Lastly, provide the option for the new employee to disclose any additional information they deem important, such as accommodation requests or special needs.

Who needs new employee information?

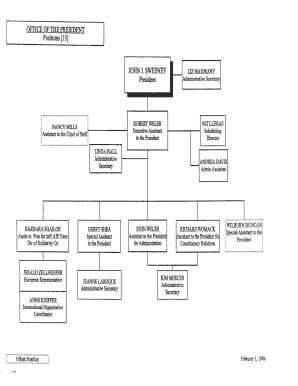

01

Human Resources department. They require this information for record-keeping, payroll processing, and ensuring compliance with legal requirements.

02

Hiring manager or supervisor. They need access to employee information to effectively manage and communicate with their team members.

03

Payroll department. They require relevant employee information to accurately process payroll and ensure timely salary payments.

04

IT department. They need employee information to create and manage email accounts, user access to company systems, and provide necessary technological support.

05

Finance department. They require employee information for expense reimbursement, tax reporting, and financial record-keeping purposes.

06

Legal and compliance departments. They may require employee information to ensure adherence to laws and regulations, especially regarding employment eligibility and work permits.

*It's important to note that employee information should be handled responsibly and stored securely to maintain confidentiality and comply with privacy laws.

Fill

paychex

: Try Risk Free

People Also Ask about payrolls by paychex inc template

How do I add a new employee on Paychex?

Continue Entering Information for a New Hire To continue entering information for a new hire, click the Continue entering information for a new hire radio button. Type the employee's last name or social security number in the Last Name or Social Security #: field. Click Search.

How do I add an employee to my Paychex Flex?

Use Give Employee Access to give employees access to this Paychex application. Click company setup | Security | System Access. Click Give Employee Access. Type the applicable employee's user name in the Username field. Type the applicable employee's password in the Password field. Click Save.

How do I remove an employee from Paychex Flex?

Click administration | Forms & Documents | Employee Documents & Links. Select the employee you want to remove an Employee Link for. Select Links from the View: drop-down menu. Click Remove for the Employee Link that you want to remove.

How do I find my employee ID on Paychex?

Employee ID's can be found by clicking on the Time & Attendance tab, and select Employees: The Paychex Client ID can be found by selecting Company from the menu: If you're not sure where to find your Paychex Codes, reach out to a Paychex representative or your payroll provider to assist you.

How do I set up an employee on Paychex Flex?

Click company setup | Security | Employee Groups. Click Assign Employees. The Assign Employees to Groups screen displays. Select the applicable Employee Group from the Display employees from: drop-down menu.

What is onboarding paychex?

Paychex Flex Onboarding creates a new employee record, so your new hire is in your human resource information system and on your payroll.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 1 move it to the cloud in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your paychex new hire paperwork as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get paychex form?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the paychex application for employment. Open it immediately and start altering it with sophisticated capabilities.

How do I complete paychex employment verification on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your paychex termination form. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is new employee information?

New employee information refers to the data collected about an employee when they are hired for a job. This typically includes personal details like the employee's name, address, Social Security number, and other relevant information needed for payroll and tax purposes.

Who is required to file new employee information?

Employers are required to file new employee information for all newly hired employees. This obligation generally applies to businesses and organizations of all sizes, as mandated by federal and state laws.

How to fill out new employee information?

To fill out new employee information, employers should collect required details from the employee, which usually includes their full name, address, date of birth, Social Security number, job title, and start date. The information should be entered into the appropriate forms, which may vary by state or jurisdiction.

What is the purpose of new employee information?

The purpose of new employee information is to ensure compliance with state and federal laws, facilitate payroll processing, report employee data for tax purposes, and establish eligibility for benefits. It also helps in tracking new hires for unemployment insurance purposes.

What information must be reported on new employee information?

The information that must be reported typically includes the employee's name, address, Social Security number, date of birth, job title, hire date, and the employer's information. Specific requirements can vary by state, so it's important to check local legislation for additional details.

Fill out your paychex new hire form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Hire Tax Form is not the form you're looking for?Search for another form here.

Keywords relevant to new employee set up form

Related to new employee paperwork

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.